EDMONTON, ALBERTA – September 9, 2021 -- Grizzly Discoveries Inc. (TSX-V: GZD; OTCQB: GZDIF; Frankfurt: G6H) ("Grizzly" or the "Company) is a diversified Canadian mineral exploration company with its primary listing on the TSX Venture Exchange that is focused on developing its precious and base metals properties, comprising over 156,000 acres, including its Robocop copper-cobalt project in southeastern British Columbia.

The global shift to clean energy systems, primarily electricity networks, is set to drive a huge increase in the requirements of copper and aluminum, with copper being a cornerstone for all electricity-related technologies, meaning that the energy sector is emerging as a major force in mineral markets.

Recently, Bloomberg’s James Attwood, wrote that according to estimates from CRU Group, the copper industry needs to spend upwards of $100 billion to close what could be an annual supply deficit of 4.7 million metric tons by 2030 as the clean power and transport sectors take off. Commodities trader Trafigura Group adds that the deficit could grow to 10 million metric tons annually if no new mines are built. Closing this annual gap would require building the equivalent of eight projects the size of the BHP Escondida property in Chile, the world’s largest copper mine.

An April 2021 report from the International Energy Agency (IEA), states that at the end of 2020 there were 10 million electric vehicles (EV) on roads around the world, an increase of some 3 million over the previous year. Registrations of EVs increased by 41% during the year, while those of non-electric cars actually dropped by 16% due to the pandemic. There can be little doubt that the future for vehicles is electric. This trend will have a great impact on the mining world.

As an exploration company, Grizzly is well-positioned for a potential business combination with a large multinational. Companies including Rio Tinto and BHP, often buy out smaller companies that have completed successful exploration projects. The process of mining is very expensive. So a junior exploration company buy-out is a win-win situation. Juniors are the tip of the spear when it comes to finding mines.

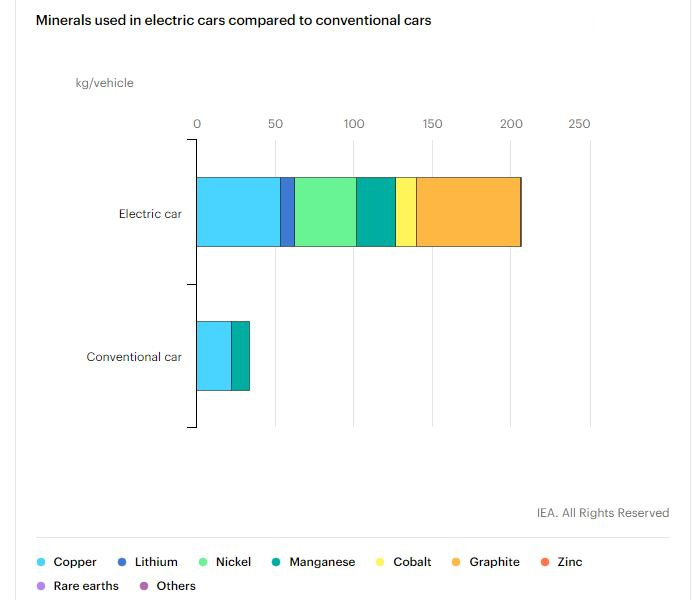

Over the past decade, the average amount of minerals needed for a new unit of power generation capacity has increased by 50% as the share of renewables in new investment has risen. A typical electric car requires six times the mineral input of a conventional car, and an offshore wind plant requires 13 times more mineral resources than a similarly sized gas-fired power plant.

Brian Testo, President and CEO of Grizzly Discoveries stated “Grizzly has significant potential for new copper-cobalt discoveries during a time when demand for battery metals is surging due to the shift to renewable energy sources and electric vehicles. We are looking forward to commencing an initial Phase 1 program over the next couple of months to isolate drill targets in preparation for a Phase 2 - 2021 drill testing. The Robocop geology and anomalies have the potential to be world-class discoveries.”

GRIZZLY DISCOVERIES INC.

Brian Testo, CEO, President

For further information, please visit our website at www.grizzlydiscoveries.com or contact:

Chris Beltgens

Corporate Development

Tel: 604 347 9535

Email:

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution concerning forward-looking information

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities laws. This information and statements address future activities, events, plans, developments and projections. All statements, other than statements of historical fact, constitute forward-looking statements or forward-looking information. Such forward-looking information and statements are frequently identified by words such as "may," "will," "should," "anticipate," "plan," "expect," "believe," "estimate," "intend" and similar terminology, and reflect assumptions, estimates, opinions and analysis made by management of Grizzly in light of its experience, current conditions, expectations of future developments and other factors which it believes to be reasonable and relevant. Forward-looking information and statements involve known and unknown risks and uncertainties that may cause Grizzly's actual results, performance and achievements to differ materially from those expressed or implied by the forward-looking information and statements and accordingly, undue reliance should not be placed thereon.

Risks and uncertainties that may cause actual results to vary include but are not limited to the availability of financing; fluctuations in commodity prices; changes to and compliance with applicable laws and regulations, including environmental laws and obtaining requisite permits; political, economic and other risks; as well as other risks and uncertainties which are more fully described in our annual and quarterly Management's Discussion and Analysis and in other filings made by us with Canadian securities regulatory authorities and available at www.sedar.com. Grizzly disclaims any obligation to update or revise any forward-looking information or statements except as may be required by law.